I am of the opinion that buy to let investment in Medway, in the long-term, will bring substantial returns for landlords, irrespective of latest regulation and tax changes.

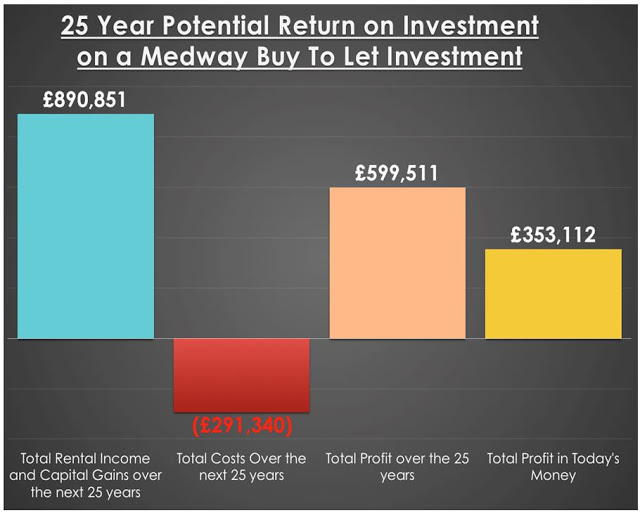

Taking a very conservative (with a small ‘c’) view, I believe landlords will see a projected net profit of £599,511 per property over the next 25 years through capital gains and rental. When inflation is taken into account that works out at £353,112 (in today’s money) or around £14,124 per year. The breakdown applies to a basic tax-paying landlord placing a characteristic 25% deposit on a £239,300 terraced/town house property.

Capital gains make up a substantial part of a landlord’s returns. Again, being conservative, I have assumed that house prices in Rochester, for instance, over the next quarter century (between 2018 and 2043) will rise at half the rate they did between 1993 and 2018 (the preceding 25 years), therefore the example Rochester property in the previous paragraph would grow in value to £728,788, providing gross capital gains of £489,488.

A typical Medway landlord receives, on average, rent of £10,500 per annum per terraced/town house property and so, over a 25-year period, that example property would generate a total rental income of £401,363 (again – very conservatively assuming a compound annual growth rate in the rent of 1.71% per annum).

Nevertheless, there are costs to running a buy to let property (mortgages, void periods, repairs, agents fees etc) .. and over those same 25 years, I have estimated that to be £291,340 .. giving the net profit levels mentioned in the second paragraph.

Now of course I have had to make assumptions to reach these figures, yet I hope you would agree, I have been very unadventurous with my assumptions.

The Medway (and UK as a whole) buy to let property market is experiencing a massive sea of change. Regulation and tax changes have altered the dynamic in the property market, diminishing its appeal to inexperienced and amateur landlords, and these new tax changes mean higher tax bills for higher rate tax landlords. Yet, despite these rising costs, there are still healthy returns to be found in Medway buy to let investment for knowledgeable and steadfast landlords. Nonetheless, the days of anything making money and idle speculation are long gone.

Buy to let is a long-term business undertaking, necessitating commitment and expertise. Don’t put your head in the sand and think it doesn’t affect you. Medway buy to let landlords must be equipped to start business and tax planning, take portfolio management advice to ensure their investments will meet their investment goals, appreciate the risks as well as the rewards, and, most crucially, the obligations they have towards their tenants.

If you are a Medway landlord, irrespective of whether you are a client of mine or another agent in Medway (or even you do it yourself), feel free to drop me a line or pop into the office for an informal chat on the future direction of the Medway rental market and where opportunities may lie.

One place for more information is my Medway Property Market blog. If you are a landlord or thinking of becoming one for the first time, and you want to read more articles like this about the Medway property market together with regular postings on what I consider the best buy to let deals in Medway, then it is well worth reading. You can also email me at spencer@docksidekent.com

If you are in the area feel free to pop into the office which is based at Station Road, Strood, Kent, ME2 4WQ

Don’t forget to visit the links below to view back dated deals and Medway Property News.

Blog – http://www.medwaypropertyblog.com/

Facebook – https://www.facebook.com/DocksideP/

LinkedIn– https://www.linkedin.com/in/spencer-fortag-medway/

Website – http://www.docksidekent.com/

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link