While Brexit has not yet had a sizeable impact on the Medway housing market, my analysis is pointing to the fact that the economic viewpoint still remains uncertain and Medway property price growth is likely to be more subdued in 2017 - although that isn’t a bad thing so, let me explain.

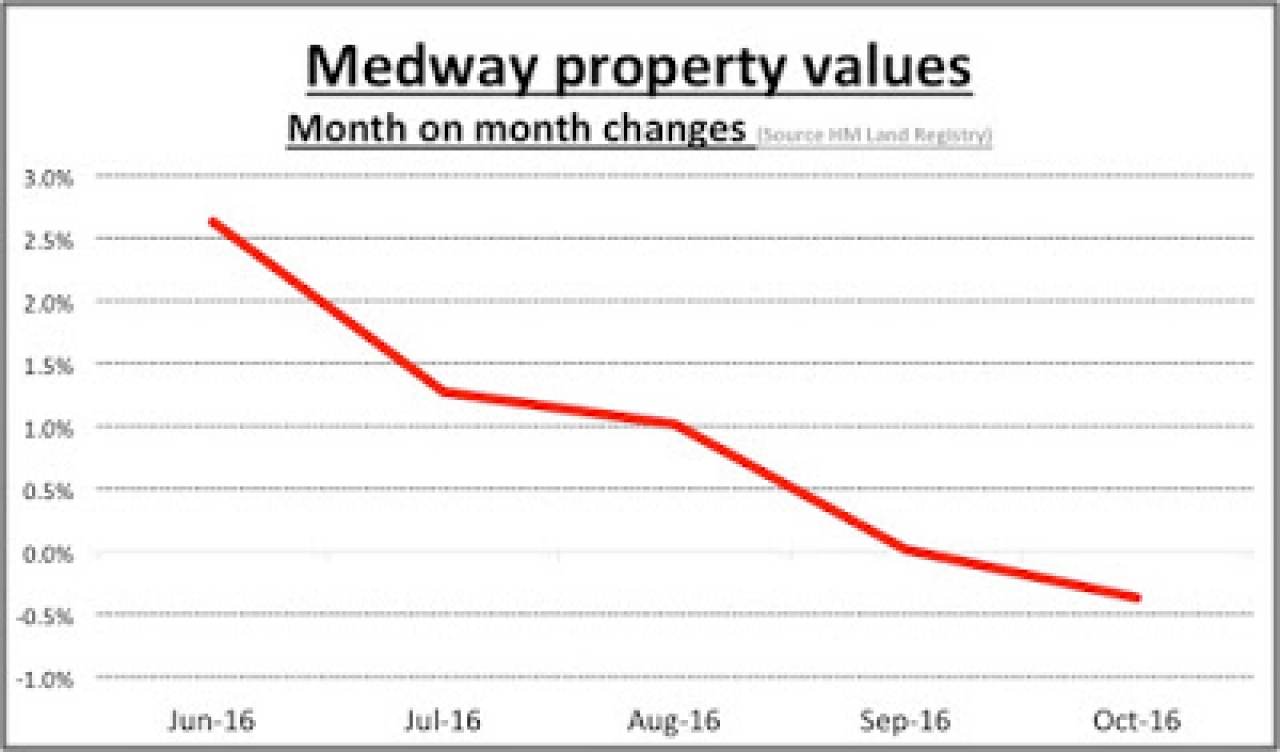

Since the summer, apart from a little wobble of uncertainty a few weeks after the Referendum vote, property values (and the economy), on the whole has outperformed what most people were anticipating. In fact, when I looked at the property prices for our Medway Council area, these were the results:

October 2016 - drop of 0.37%

September 2016 - rise of 0.01%

August 2016 - rise of 1.02%

July 2016 - rise of 1.28%

June 2016 - rise of 2.64%

The UK property market continues to perform robustly (because we can’t just look at Medway as if in its own little bubble) with annual price growth set to end this year at 6.91% and most South East region property market at 9.1%.

Talking to my London team, the significant tidal wave of growth seen from 2013 through to 2015 in the capital has subdued over the last six months. However, as that central London house price wave has started to ripple out, agents are starting to see stronger property growth values in East Anglia and the South East regions outside of London. So, fellow Medway landlords and homeowners, is this the time to get your surfboards ready for the London wave?

Well, we in Medway haven’t really been affected by what is happening in the central London property mega bubble (areas like Kensington, Chelsea, Marylebone and Mayfair ). The property market locally is more driven by sentiment, especially the ‘C’ word ... confidence. The main forces for a weaker Medway property market relate to economic uncertainty surrounding the Brexit process, which I believe will impact unhelpfully on consumer confidence in the run up to and just after the serving of the Section 50 Notice by the end of Q1 2017.

In addition, the influence of reforms to the taxation of landlords is expected to result in a reduced demand from buy to let landlords, which may limit upward pressure on property values. However, on the other side of the coin, demand from tenants has been strong, but this has been counterbalanced by a strong supply of rental properties. In my opinion, there is a slight risk of rents not growing as much in 2017 as they have in 2016, but by 2018 they could rise again to counteract Philip Hammond’s changes to tenant fees.

The broader Medway rental market looks relatively positive with modest rental growth expected and rents might rise further if landlords begin to sell properties in an effort to offset to the impact of tax rises.

So what do I predict will happen to the Medway housing market in 2017? In Medway, I believe price values are expected to fall by 2.3% in 2017 compared to a rise of 15.2% in 2016, then pick up to growth of 1.9% in 2018, 3.1% in 2019, then 4.2% in 2020 and 6.5% in 2021.

But these predictions do not take into account any effect of a possible snap General Election or further referendum on ratifying any Brexit deal (if that comes to pass in the future).

As usual, I am here to help! Are you uncertain about the future of the Medway property market? Would you like some free and impartial advice? Then please email be my CLICKING HERE

As usual, I am here to help! Are you uncertain about the future of the Medway property market? Would you like some free and impartial advice? Then please email be my CLICKING HERE

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link