Even the sanest person in Britain has to admit the Brexit vote will, in one shape or another, affect the UK Property market. Excluding central London which is another world, some commentators are saying prices could be affected by around 10%. This means that property values in Medway could be 10% lower than they would have been if we had not voted to leave the EU. What would a potential 10% drop in the Medway property market look like?

As the average value of a property in the Medway Council area is £215,500, this means property values could be set to drop for the average Medway property by £21,550. Batten down the hatches, soup kitchens and mega recession here we come. It’s going to get rough.

But before we all go into panic mode in Medway, let’s remember that the devil is always in the detail;

Look at the phrase again, and I have highlighted the relevant part “Property values in Medway could be 10% lower than they would have been if we hadn’t voted to leave the EU”.

Property values today, according to the Land Registry, are 19.02% higher than a year ago in the Medway Council area. The 12 months before that they rose by 8.5% and the 12 months before that they rose by 10.52%. If we hadn’t voted to leave, I believe that based on these figures, we could have safely assumed Medway House prices would have been 11% higher by the Summer of 2017.

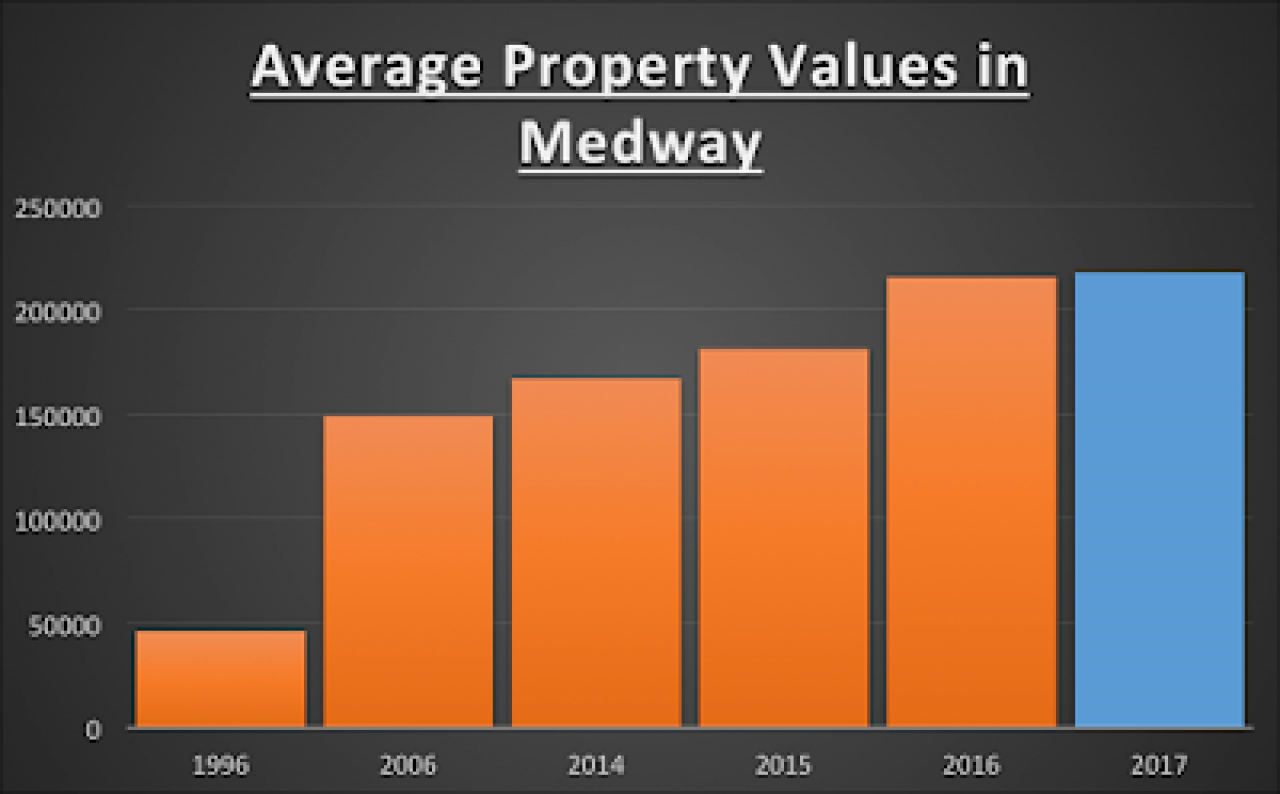

And that’s my point. We won’t see a house price crash in Medway, it’s just that house prices in a years time may well only be 1% higher than they are now. Let’s look at the historic figures and how that compares to today’s figures for the Medway Council area and Medway as a whole.

Average Value of a property 20 years ago £ 46,000

Average Value of a property 10 years ago £149,100

Average Value of a property 2 years ago £166,900

Average Value of a property 1 year ago £181,100

Average Value of a property today £215,500

Projected Value of a property in 12 months’ time £217,700

Therefore, I believe that the average value of a Medway property will be at least £2,200 higher in 12 months’ time than today.

That is not to say Medway property prices still might not dip slightly in the run up to Christmas. In fact, they always have done just about every year since 2000 and most of those were boom years. However, in 12 months time this is my considered opinion where Medway property values will be. Looking at the historic prices, even if I (and many other property market commentators) are wrong and they drop 10% from TODAY’S figure, in the whole scheme of things, we have been through a Credit Crunch, Black Monday and 15% interest rates over the last 20 to 30 years and yet Medway house prices have always bounced back.

Whilst the UK's vote for Brexit has created uncertainty in the Medway housing market, there is no need to panic and prospective buyers should merely use common sense about their purchases. I always advise people to be prudent and if you are taking out a mortgage, it is worth thinking that perhaps at some stage during the life of that mortgage, circumstances will be difficult. I do not believe we will have a 2008 credit-crunch fire-sale of properties because, after the Mortgage Market Review which took place in the Spring of 2013, mortgage borrowers are not as highly leveraged this time around. As a result of this, with any luck, there will not be too many distressed sales, which in turn cause widespread price reductions.

So, how does this affect Medway landlords? They have recently been thrashed by Osborne’s tax changes, but yields could rise if Medway house prices fall/stablise and rents grow. This might also make it easier to obtain buy-to-let mortgages, as the income would cover more of the interest cost, especially as interest rates seem to be falling. If prices were to level or come down that could help Medway landlords add to their portfolio, as rental demand for Medway property is expected to stay strong as more people find it increasingly difficult to obtain mortgages.

For more thoughts on the Medway Property market please subscribe to my Medway property newsletter HERE.

Feel free to email me with any comments or questions you may have spencer@docksidekent.com

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link