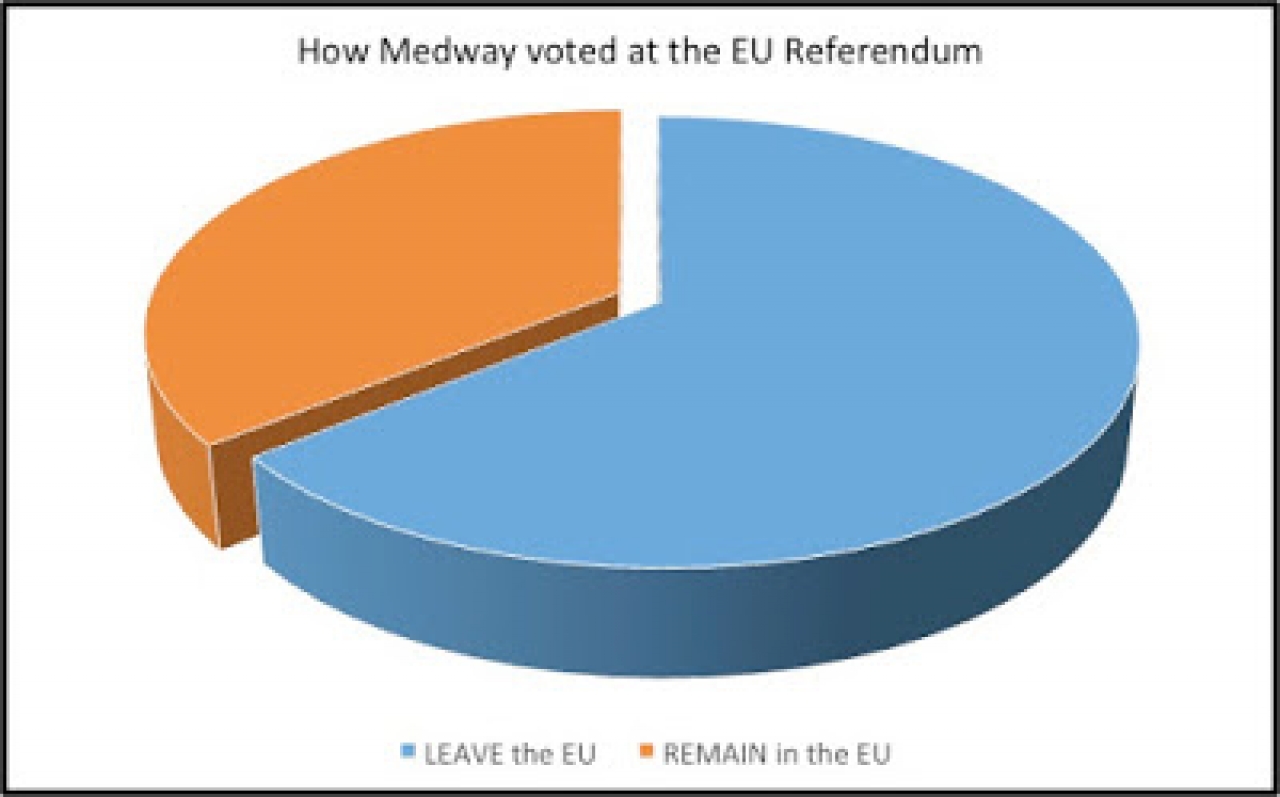

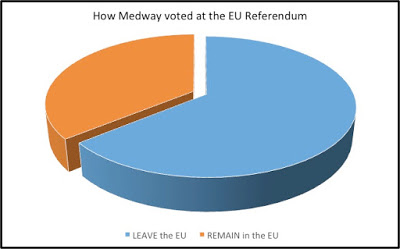

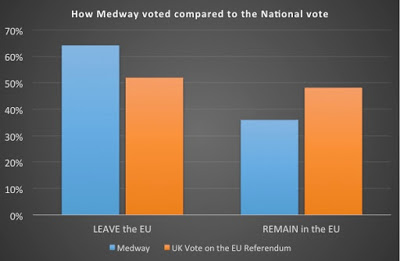

64.1% of Rochester voters voted to leave the EU – What now for Landlords and Homeowners?

I did not post this last week as I thought, that like me, you may well have been a little Brexited-out!

It was 5.50am as I started to type this article and David Dimbleby had just announced that the UK will be leaving the EU as the final votes were counted. As most of the polls suggested a Remain Vote, it came as a surprise to most people, including the City. The pound dropped 6% after the City Whiz kids got their predictions wrong and MP’s from the Remain camp are using words like “challenging times ahead”.

Now the vote has been made, what is next for the 16901Rochester homeowners especially the 9628 of those Rochesterhomeowners with a mortgage?

The Chancellor in the campaign suggested property prices would drop by 18%. Using Treasury estimates, their method of calculating this was tenuous at best, but focused around the abrupt and hasty increase in UK interest rates. An increase could raise the cost of mortgages and therefore lower demand for property prices.

Rochester Property Values

Rochester property values will probably drop in the coming 12 to 18 months; but by 18%? I am sorry but I find that a little too pessimistic and believe that figure was rhetoric to get homeowners and landlords to vote in a particular way.

Since the last In/Out EU Referendum in June 1975,

property values in Rochester have risen by 2166.7%

That isn’t a typo and whilst property prices did drop nationally by 18.7% between the peak of 2007 and bottom of the market in 2009, when one compares property values today compared to that all-time high of 2007, (the period before the financial crisis of the Credit Crunch of 2008/9) .. they are still 10.14% higher.

Another Credit Crunch?

And so, notwithstanding the Credit Crunch, the worst global economic outlook since the 1930s and the recession it brought us, a matter of a few years later, the Government were panicking in 2012/3/4 that the housing market was a runaway train.

Now, the same Credit Crunch doom-mongers and sooth-sayers that predicted soup kitchens in 2008/9 are predicting Brexit meltdown. Bad news sells newspapers. Stock markets may rise, stock markets may fall, yet the British public continued to buy property in 2009, 2010 and beyond. Aspiring first time buyers and buy to let landlords dusted themselves down, took a deep breath and carried on buying, because us Brit’s love Bricks and Mortar.

However, as mentioned previously, in the past Interest Rates have risen to reverse a drop in the pound. Whilst a cheaper pound may make your pint of Sangria a little more expensive on your Spanish holiday this year or make your brand new BMW pricier, it will also make British export cheaper. Which is great for the economy.

Interest rates

Since 2009, interest rates have been at 0.5% and lots of people have become accustomed to those sorts of levels. So what if interest rates rise? Interest rates in the 1986/88 property boom were on average 9.25%, in the 1990’s they were on around 6.5% and during the uber-boom years (when UK property values were rising by 20% a year for three or four straight years across the UK) they were at 4.5%. Many of you reading this who are in their 50’s and older will remember interest rates at 15%.

But I suspect interest rates won’t rise that much anyway, as Matt Carney (Chief of the Bank Of England) knows, raising interest rates causes deflation – which is the last thing the British economy needs at the moment. In fact they have been printing money (aka Quantitative Easing) for the last few years (which causes inflation) to the tune of £375bn a month. A bit of inflation because the pound has slipped on the money markets (not too much mind you) might be a good thing?

Whilst property values might drop in the country, they will bounce back. It’s only a paper loss and it only becomes real if you sell. If you do have to sell, again as most people move up-market when they sell, whilst your property might have dropped by 5% or 10%, the one you want to buy would have dropped by the same 5% to 10%. Here is the best part – (and work your sums out) you would actually be better off because the more expensive property you would be purchasing would have come down in value (in actual pound notes) more than the one you are selling.

The Rochester landlords of the 4086Rochester buy to let properties have nothing to fear neither, nor do the 9625tenants living in their properties.

Buy to let is a long-term investment. I think there might even be some buy to let bargains in the coming months as some people, irrespective of evidence, panic. Even if we pull up the drawbridge at Dover and immigration stopped today, the British population will still increase at a rate that will exceed the current property building level. Britain is building 139,600 properties a year but needs, according to the eminent ‘Barker Review of Housing Supply Report’, to build about 250,000 properties a year to even stand still. As the birth rate is increasing, the population is living longer and just under a quarter of all UK households now are occupied by a single person demand is only going up whilst supply is stifled. Greater demand than supply equals higher prices. That is definitely a fact.

So, what will happen next?

Well, there are many challenges ahead. The country has spoken and we are now in unchartered territory – but we have been through a couple of World Wars, an Oil Crisis, Black Monday, Black Wednesday, 15% interest rates and a Credit Crunch … and we survived!

And the value of your Medway property? It might have a short term wobble… but in the long-term it’s as safe as houses.

Feel free to email me HERE with any concerns or questions you may have about Brexit and your property.

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link