In my last article I wrote about the plight of the Medway 20-something’s often referred to by the press as Generation Rent. Attitudes to renting have certainly changed over the last twenty years and as my analysis suggested, this change is likely to be permanent. In the article, whilst a minority of this Generation Rent feel trapped, the majority don’t – making renting a choice not a predicament. The Royal Institution of Chartered Surveyors (RICS) predicted that the private rental sector is likely to grow by 1.8m households across the UK in the next 8 years, with demand for rental property unlikely to slow and newly formed households continuing to choose the rental market as opposed to buying.

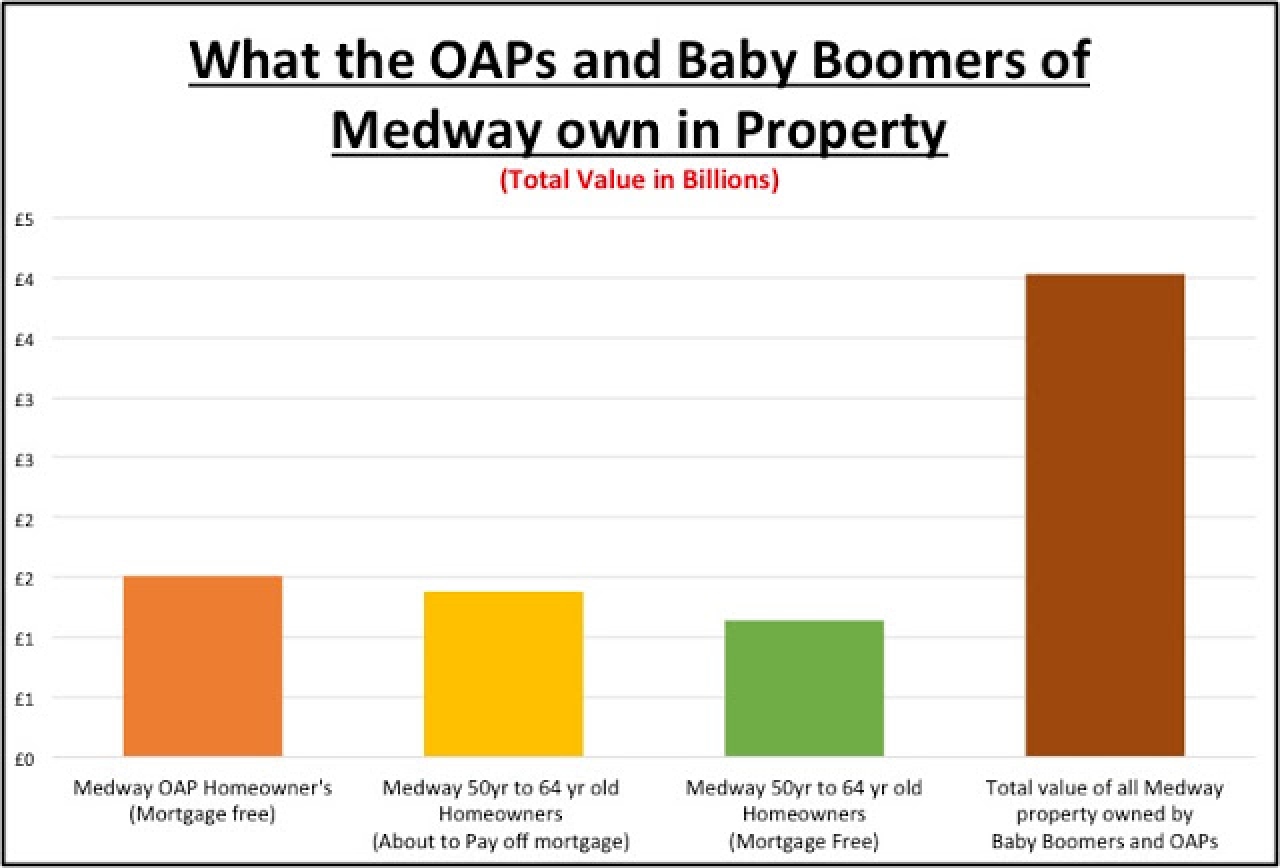

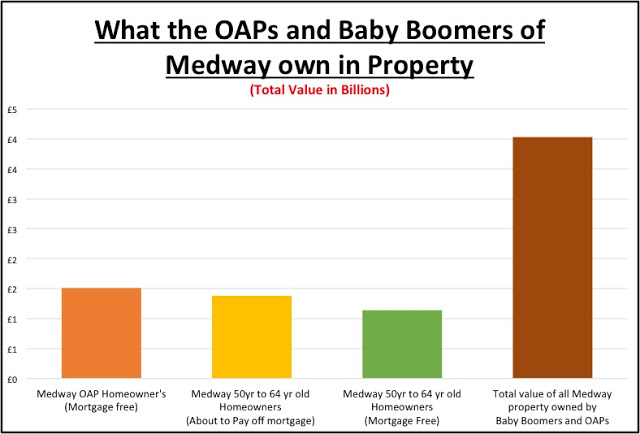

However, my real concern for Medway homeowners and Medway landlords alike, as I discussed a couple of months ago, is for our mature members of the population of Medway. In that previous article, I stated that the current OAP’s (65+ yrs in age) in Medway were sitting on £1.51bn of residential property. However, I didn’t talk in depth about the Baby Boomers, the 50yr to 64yr old population and what their properties are worth – and more importantly, how the current state of affairs could be holding back those younger Generation Renters.

In Medway, there are 5,749 households whose owners are aged between 50 and 64 years old and about to pay their mortgage off. That property is worth, in today’s prices, £1.38bn. There are an additional 4,769 mortgage free Medway households, owned by the same age sector, worth around £1.14bn in today’s prices, meaning...

These Medway Baby Boomers and OAP’s are sitting on 16,808 Medway properties and many of them feel trapped in their homes, and hence I have dubbed them Generation Trapped.

Recently, the English Housing Survey stated 49% of these properties owned by the Generation Trapped, as I have dubbed them, are under-occupied (under-occupied classed as having at least two bedrooms more than needed). These houses could be better utilised by younger families, but research carried out by the Prudential suggests that in Britain it is estimated that only one in ten older people downsize while, in the USA for example, one in five do so.

The growing numbers of older homeowners who want to downsize their home are often put off by the difficulties of moving. The charity United for all Ages, suggested recently many are put off by the lack of housing options, 19% by the hassle and cost of moving, 14% by having to de-clutter their possessions and 14% by family reasons such as staying close to children and grandchildren.

Helping mature Medway homeowners to downsize at the right time will also enable younger Medway people to find the homes they need – meaning every generation wins, both young and old. However, to ensure downsizing works, as a Country, we need more choices for these last time buyers.

Theresa May and Philip Hammond can do their part and consider stamp duty tax breaks for downsizers, our local Council in Medway and the Planning Department should play their part, as should landlords and property investors to ensure Medway’s Generation Trapped can find suitable property locally, close to friends, family and facilities.

Are you thinking of downsizing? Perhaps you are struggling to get your foot on the first rung of the property ladder? I am happy to offer free and totally impartial advice. Please use this link to CONTACT ME

You can also sign my for my free and insightful monthly Medway property market report by simply CLICKING HERE

Thanks for reading.

Spencer Fortag.

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link