Recently I was having a chat with one of my cousins at a big family get-together. The last time I had seen them their children were in their early teens. Now their children are all grown up, have partners, dogs and children. I can not believe how quickly time

I got talking over a glass of something bubbly with my second cousins and a couple of their children, about the times of 15% interest rates and how the more mature members of our family had to endure the 3 day week, 20% inflation and the threat of nuclear annihilation in 4 minutes. Foolishly, I then said what with all the opportunities youngsters had today, they had never had it so good!

One of my cousin’s kids gained some financial/economics qualifications before going to Law School, and they explained their perspective of the economic predicament of Millennials. They explained that, in their opinion, a combination of student debt, unemployment, global proliferation, EU migration and rising house values is reducing the salaries and outlook of masses of the UK’s younger generation, causing an unparalleled disparity of wealth between the generations. Naturally, I asked why that was?

They said Millennials were paying the price for the UK’s most spectacular bookkeeping catastrophe to date (bigger than the bank bailout after the creditcCrunch). Back in the 1950’s and 1960’s, nobody predicted us Brit’s would live as long as we do today, and in such abundant numbers. The OAP pensions that were promised in the past (be that the Government state pension or company final salary schemes) which appeared to be nothing fancy at the time, are now burdensomely over-lavish, and that is hurting the Millennials of today and will do so for years to come. Bringing it back to property, the cousin stated that baby boomers born between 1945 and 1965 have been big recipients of the vast rising house prices over the 1970’s, 80’s, 90’s and 2000’s. Add to that their decent pensions, meaning cumulatively, their wealth has grown exponentially through no skill of their own.

This disparity of wealth between the older and younger generations could have unparalleled consequences for the living standards of younger Millennials…. So HoustonGillingham – do we have a problem?? Well Medway Property Blog readers, you know I like a challenge. I can’t disagree with some of what the younger family member said, but there are always two sides to every story, so I thought I would do some homework on the matter.

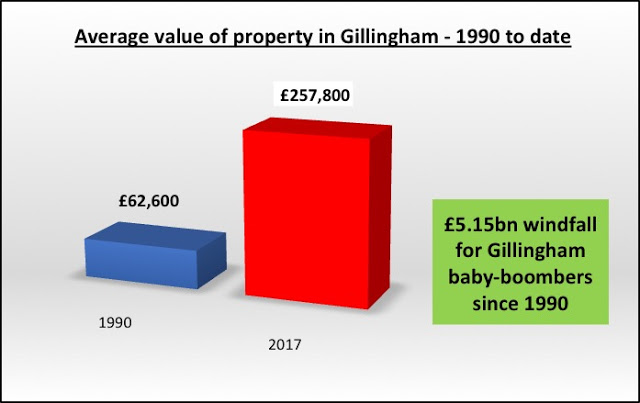

Since 1990, the average value of a property in Gillingham has risen from £62,600 to its current level of £257,800. As there are a total of 26,399 homeowners aged over 50 in Gillingham; that means there has been a £5.15bn windfall for those Gillingham homeowners fortunate enough to own their own homes during the property boom of the 1990s and early 2000’s.

I must admit that the growth in property values in the 1990’s and 2000’s has certainly helped many of Gillingham’s baby boomers. The figures do appear to put into reverse gear the perceived wisdom that each generation gets wealthier than the previous one. With all this wealth, the figures do back up the youngsters argument that Millennials are being priced out of home ownership. Or do they? Are they? Next time, I will carry on this discussion where I will give the Baby Boomer’s defence to the prosecution’s case!

In the mean time, feel free to email me HERE; it would be great to hear from you no matter what age-group you fall in.

You are also invited to use this free and INSTANT valuation tool. It will give a current sales and rental value on any DA or ME post code address, try it NOW

Thanks for reading.

Spencer Fortag

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link