Should you buy or rent a home? Buying can be expensive but could save you money over the years. Renting a property through a letting agent or private landlord offers less autonomy to live by your own rules but with more flexibility if you need to move.

Yet, there is third way that many people seem to forget and it plays an important role in the housing of Medway people. Collectively known as social housing, it is affordable housing, which is let by either Medway Council or a housing association to those considered to be in specific need, at rents below those characteristic in the private rental market.

In Medway, there are 4,577 social housing households, which represent 14.8% of all the households in Medway. There are a further 20,651 families in the Medway council area on the waiting list, that’s a huge jump of 215% from the 6,544 families on the same waiting list in 2005.

Nevertheless, this doesn't necessarily mean that more families are being supplied with their own council house or housing association property. Six years ago, Westminster gave local authorities the authority to limit entitlement for social housing, quite conspicuously dismissing those that did not have an association or link to the locality.

Interestingly, the rents in the social rented segment have also been growing at a faster rate than they have for private tenants. In the Medway council area, the average rent in 1998 for a council house/housing association property was £190.88 a month. Today its £365.13, a rise of 91% in 19 years.

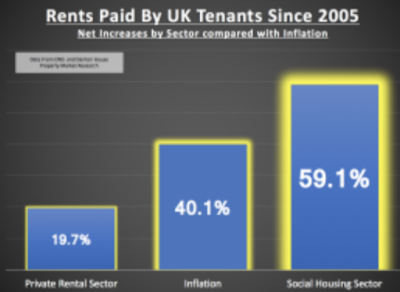

When comparing social housing rents against private rents, the stats don’t go back to the late 1990’s for private renting, so to ensure we compare like for like, we can only go back to 2005. Over the last 12 years, private rents have increased nationally by a net figure of 19.7%, whilst rents for social housing have increased by 59.1%.

So, what does this all mean for the homeowners, landlords and tenants of Medway?

Rents in the private rental sector in Medway will increase sharply during the next five years. Even though the council house waiting list has decreased, the number of new council and housing association properties being built is at a 70 year low. The governments crusade against buy-to-let landlords together with the increased taxation and the banning of tenant fees to agents will restrict the supply of private rental property, which in turn, using simple supply and demand economics, will mean private rents may rise – making buy to let investment a good choice of investment again (irrespective of the increased fees and taxation laid at the door of landlords). It will also mean property values will remain strong and stable as the number of people moving to a new house (and selling their old property) will continue to remain restricted and hence, due to lack of choice and supply, buyers will have to pay decent money for any property they wish to buy.

Interesting times ahead for our local property market!

Obviously, everyones circumstances are slightly different. You may be wanting to buy your first investment property or simply want to know which area is a good bet for capital growth. Not to worry, I am here to help! Simply email me your question using THIS LINK and I will do my best to offer you impartial and ethical advice.

Until next time.

Spencer Fortag

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link