Who remembers the good ol’ days of the 1970’s and 1980’s? With such highlights lowlights as 24% inflation, 17% interest rates, a 3 day working week, 13% unemployment and power cuts, but at least people could afford to buy their own home. So why aren’t the 20 and 30 something’s buying in the same numbers as they were 30 or 40 years ago?

Many people blame the credit crunch and global recession of 2008, which had an enormous impact on the Medway (and UK) housing market. Predominantly, the 20-something first-time buyers who, confronting a problematic mortgage market, the perceived need for big deposits, reduced job security and declining disposable income, discovered it simply too challenging to get on to the Medway property ladder.

However, I would say there has been something else at play other than the issue of raising a deposit - having sufficient income and rising property prices in Medway. Whilst these are important factors and barriers to homeownership, I also believe there has been a generational change in attitudes towards home ownership in Medway (and in fact the rest of the Country).

Back in 2011, the Halifax did a survey of thousands of tenants and 19% of tenants said they had no plans to buy a home for themselves. An almost identical survey of tenants, carried out by The Deposit Protection Service revealed, in late 2016, that figure had risen to 38.4%. It seems that many no-longer equate home ownership to success and believe renting to be better suited to their lifestyle.

You see, I believe renting is a fundamental part of the housing sector, and a meaningful proportion of the younger adult members of the Medway population choose to be tenants as it better suits their plans and lifestyle. Local Government in Medway (including the planners – especially the planners), land owners and landlords need an adaptable residential property sector that allows the diverse choices of these Kent-based 20 and 30 year olds to be met.

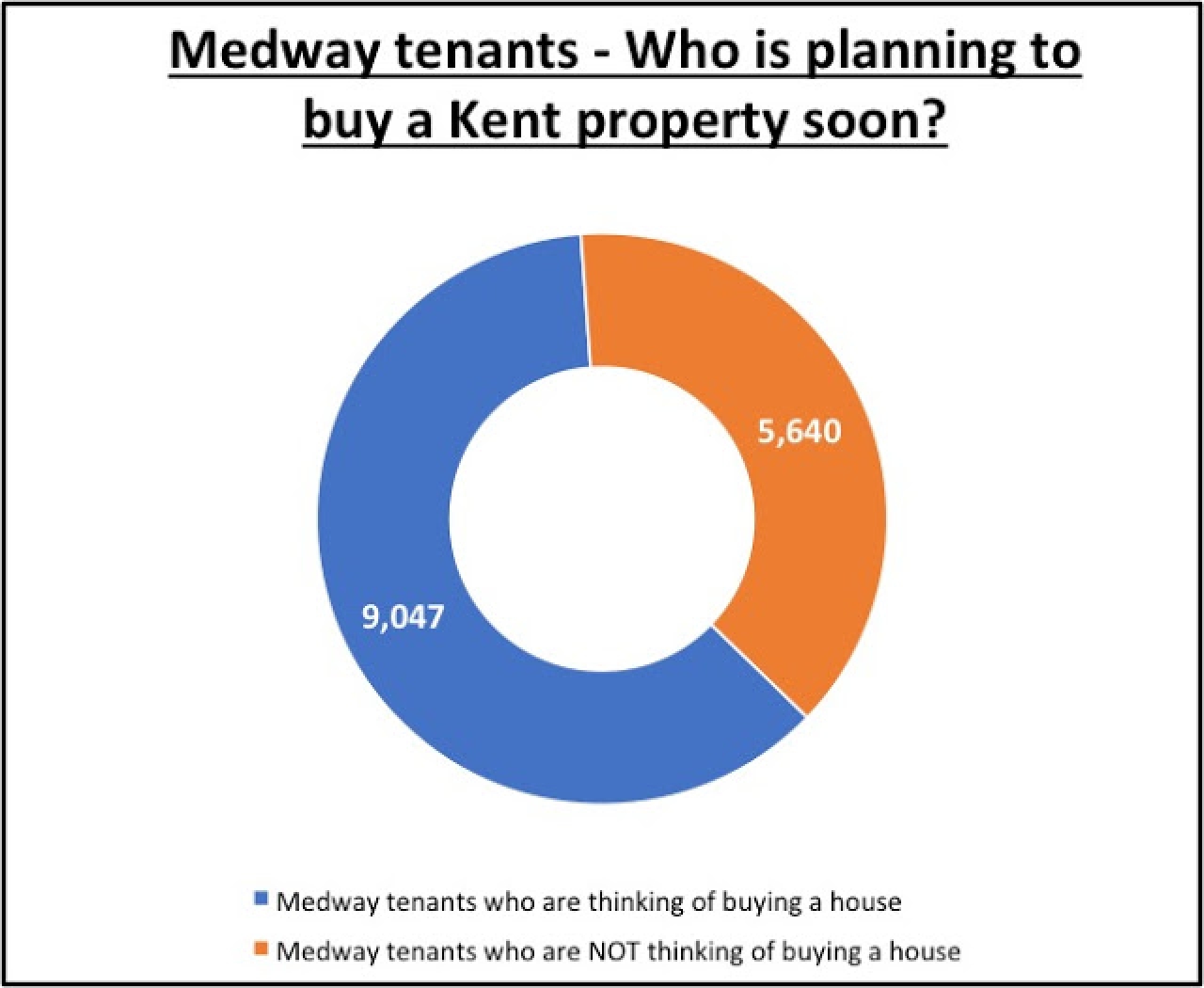

This means, if we applied the same percentages to the current 14,687 Medway tenants in their 5,657 private rental properties, 5,640 tenants have no plans to ever buy a property – good news for the landlords of those 2,172 properties. Interestingly, in the same report, just under two thirds (62%) of tenants said they didn’t expect to buy within the next year.

So does that mean the other third will be buying in Medway in the next 12 months?

Some will, but most won’t. In fact, the Royal Institution of Chartered Surveyors (RICS) predicts that, by 2025, the number of people renting will increase, not drop. Yes, many tenants might hope to buy ,but the reality is different for the reasons set out above. The RICS predicts the number of tenants looking to rent will increase by 1.8 million households by 2025, as rising house prices continue to make home ownership increasingly unaffordable for younger generations. So, if we applied this rise to Medway, we will in fact need an additional 2,424 private rental properties over the next eight years (or 303 a year), meaning the number of private rented properties in Medway is projected to rise to an eye watering 8,081 households.

Do you own a property in Medway and would like some impartial advice about the future of the housing market? Simply sign up to my Medway property newsletter and once a month you will receive a free copy, full of useful facts and figures, just like this very article. You can sign up, for FREE. by clicking HERE

You can also value your home, for free and instantly, without even having to speak to one of those pesky estate agents! It takes under 58 seconds for a current sales and rental value. The link is HERE

As ever, thanks for reading.

Spencer Fortag

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link