A Medway homeowner contacted me last week, following my article posted in the Medway Property Blog about the change in attitude to renting by the youngsters of Medway and how they thought it was too expensive for first time buyers to buy in Medway. There can be no doubt that buy to let landlords have played their part in driving up property values in Medway (and the UK) and from that made housing a lot less affordable for the 20 and 30 somethings of Medway.

The homeowner said that they thought the plight of the first-time buyers in Medway was like a novice tennis player playing against Andy Murray. If you played him once you will unquestionably lose and if you were to play him 100 times you would lose 100 times. That is what they thought it was like for all the 20-something first time buyers of Medway going up against all the buy to let landlords.

They then asked if the Bank of England (BoE) should be tasked to control house price inflation in the same way as the BoE controls inflation. The BoE has a target for the annual inflation rate of the Consumer Prices Index of 2%, whilst it is also required to support the Government’s economic policy, including its objectives for growth and employment. So, should the BoE be charged with containing the buy to let housing market, by possibly changing the rules on the loan-to-value (LTV) ratio’s?

First,lets look at how affordable Medway is. The best measure of the affordability of housing is the ratio of Medway property prices to Medway average wages, (the higher the ratio, the less affordable properties are). Looking at the table below, for example in 2014, the average value of a Medway property was 6.50 times higher than the average annual wage in Medway.

1998 | 2000 | 2002 | 2004 | 2006 | 2008 | 2010 | 2012 | 2014 | 2016 (EST) |

2.95 | 3.66 | 4.47 | 6.03 | 6.12 | 6.40 | 5.69 | 6.03 | 6.50 | 7.98 |

This deterioration in affordability of property in Medway over the last couple of years has been one of the reasons why the younger generation is deciding more and more to rent instead of buy their own house.

But, it’s not the only reason.

A quick look on Money Supermarket today found 169 lenders prepared to offer 75% LTV buy to let mortgages and none at 85% LTV. Lenders seem to have self-imposed a high level of entry for buy to let landlords. The BoE don’t need to meddle there.

Additionally, the Tories have certainly done much to level the playing field in favour of first time buyers. For nearly a year now, Landlords have had to pay an additional 3% in stamp duty on any buy to let purchases and, over the coming four years, tax rules on landlords claiming mortgage interest relief will affect their pocket. It also does not help owner-occupiers that local authorities sold off council houses in the Thatcher years. So, for many on low incomes or with little capital, owning a home has simply never been an option (today or in the past).

It’s easy to look at the headlines and blame landlords. First time buyers have been able to access 95% LTV mortgages since 2010, meaning even today, a first-time buyer could purchase a 1 bed apartment in Medway for around £150,000 and only need to find £7,500 deposit. Yes, a lot of money, but first time buyers need to decide what is important to them. Either, save up for a couple of years for the deposit or go and have two annual foreign holidays, get the full satellite or cable TV package with sports and movies costing three figures a month, upgrade to the latest mobile phone and go out socialising .

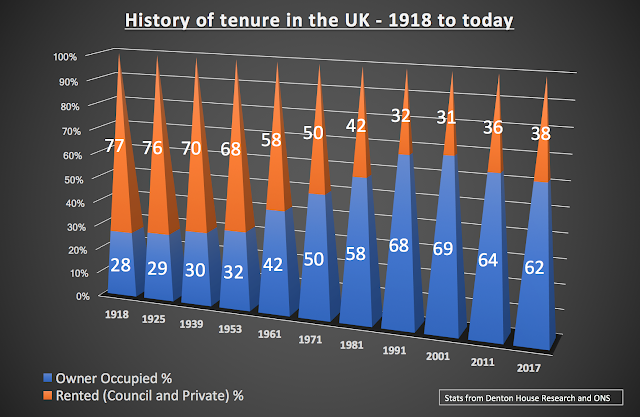

I think we as a country have changed. Renting seems to be returning to be the norm.

So, my opinion is, landlords have it tough. Let’s not blame them for the perceived woes of the nation. To be frank, we haven’t always been a country of homeowners. Roll the clock back to 1964, and nationally, 30% of people rented their home from a private landlord.

That figure today?

It's only 15.3% nationally.

Are you a landlord concerned about the future? A first time buyer wondering if now is a good time to buy? Feel free to email me for free and impartial advice.

I also have a YouTube channel that covers loads of property topics. You can watch it here.

Thanks

Spencer

Are you a landlord concerned about the future? A first time buyer wondering if now is a good time to buy? Feel free to email me for free and impartial advice.

I also have a YouTube channel that covers loads of property topics. You can watch it here.

Thanks

Spencer

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link